Half Time Report: Bitcoin Bros and Pot Stocks Trade Places, IPOs Go Nuts

Six months ago I suggested that the euphoric stock returns and fervor of Bitcoin Bros which characterized 2017 were soon to change. Though the days of easy layups are gone, we’ve shifted to a market where outside shots still create winning combinations.

My core thesis in December was that easy money had lifted all boats, and that eventually high tides reverse. Remember, every country of the 45 tracked by the OECD had net growth in 2017. All sectors but energy (an input you want low) were soaring, with indexes full of companies mostly all trending up. The ‘everything up and to the right’ land of low volatility was a happy aberration. So, as interest rates would rise to keep already growing inflation in check, the gravity of that shift would reverse those circumstances.

We continue to be in the longest economic expansion in US history, though as the Washington Post notes it comes at the price of federal deficits made structural in tax cuts. But from record low unemployment to what the Wall St. Journal describes as a blistering IPO market raising $35.3 billion for 120 US companies, there are reasons to be bullish on the general US economy. But as you’ll see US and global markets have retreated, and the mania of cryptocurrencies as cooled.

Cryptocurrencies are speculative

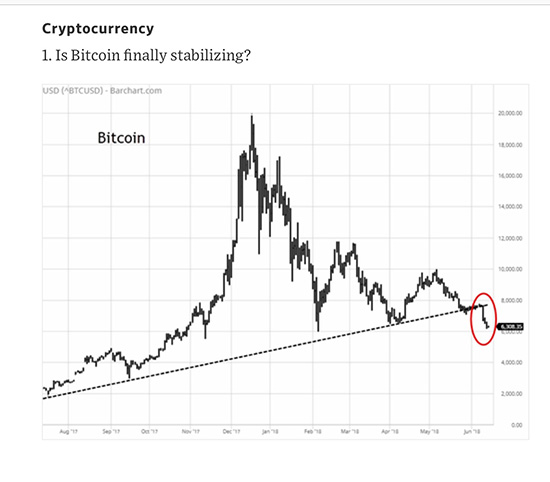

I lived through the dot.com smug fest, and bought my tidiest colleague’s work desk at our start-up’s bankruptcy auction. So, trust me, I’m a fair judge of economic mania. Bitcoin is now down 70% for the year. That’s a deeper crater then what was left by the dot.com crash. Yesterday Wired reported that 800 cryptocurrencies are now worth less that a penny. What’s the maximum number of worthless currencies that can be created? I imagine its the limit of human greed, optimism and naivety. This history of cryptos hasn’t been written in ink yet. But grad students aren’t telling me they putting their tuition in to cryptos anymore. That seems smart.

Just as digital technology and websites had a better life after their bubble, Blockchain will endure, transform and create value too. But my thesis was, there’s no underlying asset other than buyer sentiment — and no scarcity. As soon as a coin drops, buyer sentiment can move a new one. But, even in a Warner Bros. cartoon, one can only run on lily pads so long. ;>

Bitcoin might be a good bet for slower growth the in the second half of the year. But its dependent on buyer sentiment. At best its currency speculation. At worst there will be accusations of accusations of fraud, hacked records, and the case for regulation to provide reassurance for regrowth has just started. Stay tuned.

Index Investing Hits the Wall of Tight Money

The other thesis I advanced was that investors were anxious about being at the top of the business cycle. As as low interest raised all boats, there have been broad declines in global and US markets. In the last week, investors have pulled $25 billion in funds from U.S. markets, and $30 billion from global markets, the third largest weekly outflow ever. Of course there are winners. Japan and bonds have seen significant inflows. But make no mistake, this is now a stock pickers market. Ironically, you can bet against indexes, which its self is well, a reverse index. The Rydex Inverse S&P 500® Fund bets against that whole S&P. ProShares Short Emerging Mkts Fund does this same thing on emerging market indexes. For several months they’ve been a profitable counter balance to declining indexes.

Someone recently told me that indexes are a bit like cable subscriptions — you get a ton of choices, but many you would never buy individually. When money is easy with nowhere else to go, these low gainers work out. But when capital is expensive, and funds have a safe harbors, then only the most successful companies stand out. That’s where we are as the year’s second half starts, a stock pickers market.

What about Pot Stocks?

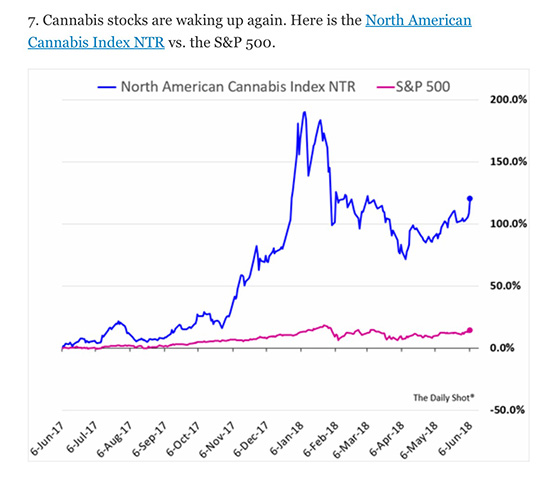

Its hard to miss the degree to which companies bringing legalized pot to market have outperformed the general markets.

There’s a huge range of activity around the legalization of cannabis in US states and Canada. Medical research on pain relief, neurological disorders, glaucoma, as well as tests for intoxication, and DNA research of plant strains. Last week GW Pharmaceuticals became the first company to win Food and Drug Administration (FDA) approval for a marijuana plant-based prescription drug, Epidiolex. Just yesterday my state, Massachusetts, issued its first legal sale license. Jeff Sessions’ objections aside, this slow boat seems to be arriving.

US federal law has discouraged institutional investment in this emerging industry. That’s created an opening for a different set of risk investors. Buyers want legalized pot, states need to close deficits and covet taxes and economic growth. So, business is answering that call. Firms in distribution, branding, and running efficient marketplaces are getting in to position to serve a market which has yet to be made. Each vote for legalization, every new jurisdiction that opens markets as my state just did, is one more catalyst to take this industry seriously.

This is an amazing time in business. Two more potential interest increases, a reckoning of a federal deficit and healthcare inflation, trade war and military saber rattling, and the world’s tenth largest economy legalizing pot on our very long border. Come visit me @UsefulArts on Twitter where I’m tweeting on this stuff in short frequent bursts, or leave a comment here.

Happy 4th of July.

The future of digital experiences will be built by strategists who grasp the full array of emerging business, social, and technical models. Specialties in user experience, branding, application design, and data science are laying the foundation for richer user experiences and business models breakthrough products and revenue based marketing.

The future of digital experiences will be built by strategists who grasp the full array of emerging business, social, and technical models. Specialties in user experience, branding, application design, and data science are laying the foundation for richer user experiences and business models breakthrough products and revenue based marketing.

5 Responses to "Half Time Report: Bitcoin Bros and Pot Stocks Trade Places, IPOs Go Nuts"

September 1, 2020

Sexy chat with hot young ladies for free at sex harburg! So try it right now!

September 24, 2020

This is very interesting, but it is necessary to click on this link: sexcontact amsterdam

July 5, 2021

If you want to find casual sex contacts for hot chat in United Kingdom visit sex in manchester and you will not regret it

April 29, 2022

Wow, I love it! Thank you so much for sharing

June 1, 2022

Wow, I love it! Thank you so much for sharing