Bitcoin Bros and Anxiety at the Top of the Business Cycle

One of the pleasures working with people leading business change is thinking with them about how markets and culture come together. We tend to focus on how changes affect their teams, and ways their business can mean more to customers and their broader community. As the year ends, I’d like to share my view of some economic trends, and what they may mean as we head in to next year.

Welcome to the top of the business cycle

The world economy is in a euphoric phase of business expansion. Of the 45 countries tracked by the Organization for Economic Cooperation and Development, exactly all of them are on pace to have expanded synchronously in 2017.

The world economy is in a euphoric phase of business expansion. Of the 45 countries tracked by the Organization for Economic Cooperation and Development, exactly all of them are on pace to have expanded synchronously in 2017.

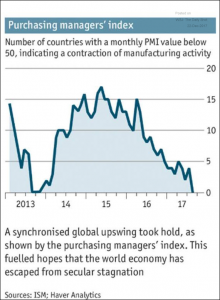

Likewise, the Purchasing Managers Index which tracks manufacturing in fifty countries, shows all of them expanding this year. Of the approximate 200 days on which stocks are traded, the Dow Jones Average set records 71 times, the most ever. That’s a smooth, confident market.

And while the US market was good, world markets were stronger still. Business and culture are mutually enabling, so with this decade long pattern of recovery, we’ve seen increasing benefits including the expansion of zero carbon energy, reductions in world poverty and disease, and an increased focus on wellness and sustainability in developed economies.

The Christian Science Monitor is one of the few publications that covers human progress as a lens on the news, and visiting there gives assurance that progress, even on difficult changes, is both possible and taking place daily. Its good to remember that progress is a lagging indicator of effort and commitment. By the time we see something new, it may have been worked on or perfected over years.

Over the next year, I’ll be taking a closer look at how managers and designers can encourage that kind of human progress, and what score boards might be used to measure our progress beyond the business outcomes that are often the starting points for our work. Meanwhile, let’s start with one of the biggest stories of the year.

The Bitcoin Bros are everywhere

Its always nice to be asked for opinions, and recently people I’d have not expected are asking about Bitcoin. I’ve had measured investments in Bitcoin and other synthetic currencies and the firms behind them. Its no surprise they’ve been really rewarding, after all, Bitcoin surged from $969 to $14,292 in just this year. That’s crazy and awesome. So, without giving advice, here’s my take on where I believe we’re at.

This month, a Bitcoin wallet, Coinbase, briefly became the most downloaded iPhone app, beating out YouTube. When a speculative investment gets more popular than cat videos, a saturation point may be at hand. And when junk ads for it start to eclipse the usual Internet shysterism, a mania is reasonably being fueled.

This month, a Bitcoin wallet, Coinbase, briefly became the most downloaded iPhone app, beating out YouTube. When a speculative investment gets more popular than cat videos, a saturation point may be at hand. And when junk ads for it start to eclipse the usual Internet shysterism, a mania is reasonably being fueled.

This idea was driven home when a sixteen-year-old friend of my daughter checked his 1/40 of a coin holding, and matter of faculty noted that it was up 30% in just that weekend. Grad students tell me this was how they are growing and are keeping their “rainy day funds”. This isn’t normal, and I’m not sure either of these folks could see that. Here’s the risk…

There’s no limit to the number of new currencies that can be spun-spun up. Perhaps you’ve noticed that Overstock.com has remade its self as a synthetic currency company. Bitcoin’s price comes from its scarcity exceeding demand in a given moment. There are now over 200 synthetic currencies. Should Bitcoin decline, perhaps driven by rumor or scandal, switching to a non-declining coin may be far more attractive than buying-in on a falling one.

Bitcoin and the like are being used more as speculative instruments than currencies. As a currency, Bitcoin is a poor store of value, both due to volatility driven by sentiment, and that it must be stored in wallets which restrict its unlimited trade.

I also worry that the stratospheric returns of Bitcoin are exactly what early stage investors seek, and that they may have a considerable investment in this space. There may be some risk that a correction could gut the funders of young companies, or even empty their treasuries of such firms if they are unwisely exposed to such speculation.

We all know a Bitcoin Bro who sees cryptocurrency’s spread as confirming they are shape of what is still to come. His swagger (why is it always a he?) is fueled by the tech-inspired idealism of a Peter Thiel combined with the certainty of Ayn Rand’s Darwinistic simplicity. The video below captures this spot-on, a level of self-absorbed drama that goes with being at one’s first rodeo and clueless to the point of self-peril.

Seriously, high fives to everyone who’s earned gains from such investments. If you haven’t, perhaps its time to take some rewards, you’ve earned them. That’s not advice, but it is a reminder. Gains are good, get them while they’re fresh.

The US dollar and American lifespan declined in 2017

Have you noticed the US dollar is off 7.5% for the year? This is a big deal, and comes after five years of gains. It puts the story arch of this great financial year in a somewhat different light. If gains are measured in dollars, then a portion of that growth is from that devaluation. The Dow’s 25% growth is diminished once you factor in that one quarter of that was a currency effect.

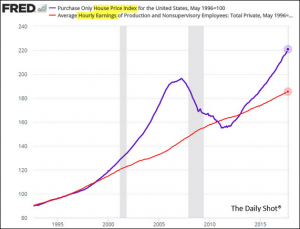

Optimism, fueled by tax cuts pervades Wall Street. But the stress on Main Street is killer. US housing prices have diverged sharply from wage growth, in a way which reminds me of the unchecked growth in high education expenses. We are watching Thomas Piketty’s Capital in the Twenty-First Century being played out in real-time.

Optimism, fueled by tax cuts pervades Wall Street. But the stress on Main Street is killer. US housing prices have diverged sharply from wage growth, in a way which reminds me of the unchecked growth in high education expenses. We are watching Thomas Piketty’s Capital in the Twenty-First Century being played out in real-time.

Euphoric markets, asset inflation, and now wage growth driven by 18 states increasing minimum wage makes four interest rate hikes in 2018 quite likely. Consumer revolving debt already exceeds pre-recession levels. Consistent with this, we’re seeing an increasing default rate on auto loans, which suggests the economic good times in the stock market are far from evenly distributed.

Rather than building a safety net for when this business cycle declines, we’re extending the euphoria in ways that decrease our capacity to manage its inevitable decline. And some pernicious and destructive social problems are growing.

New data shows that deaths from opioid addiction in the US has reached such a scale that its now lowering the aggregate US lifespan. And I would assert here that high earners will be less represented in these deaths. Here’s some insight on why the opiod crisis is unique to the US, and they way power and money prevented a solid DEA case from holding the company behind it responsible.

I have previously written that the richest 20% of American’s now have a different lifespan than lower income groups. This is as serious a policy issues can be, and its not breaking through the chatter of the bread and circus which passes for political discourse in the United States.

The privileged are euphoric, but the majority are anxious

2017 will stand out in my mind as the year that Stapes added a fidget section, and the year my family became more involved with the mental health treatment. Academic research concludes one third of the population is affected by an anxiety disorder; the New York Times describes it as the most diagnosed mental condition in the United States.

This has been attributed to ubiquitous mobile technology, increasing elder dementia, raising kids wrong, and a political fixation on a gridlocked system producing more polemics than polity. The Washington Post just outright wrote the headline: Trump’s Making Us Crazy. Personally, I add reality television to that list, the kind that turns everything from cooking to pottery in to a judged contest.

Still, just knowing that a fifth of our friends and customers have diagnosable anxiety at any time is a starting point for thinking about how and when we connect with them. Its also a warning to designers to consider how digitization plays in to this, and where mitigation or measurement would be bring benefits beyond immediate business goals.

Time to de-politicize government

We’re ending the year strong on gains, but short on unity. At the start of the Federalist Papers, Hamilton called for a commitment to a national mission superseding individual benefit.

Today, no US political party has elder leaders projecting a program that goes much beyond ‘punch the other guy’.

Broad based growth is needed for a healthy economy and culture, and I’m not alone in calling for this. Boston Consulting Group Chairman Hans-Paul Bürkner recently noted that in today’s global economy, many people feel trapped and “want their futures back.” The answer to this, he says, is delivering inclusive growth. In the US, a lack of campaign finance control allows outright investment in policy outcomes, and it marginalizes voters through the construction of safe districts constructed to bias outcomes toward those drawing district lines. To return self-agency to people, leveling the playing field for interacting with government at every level is essential.

Has our idealism for markets became greater than our belief in each another?

Education reform will be the civil rights issue of the next fifty years, and it has barely started. The one-fifth of our economy devoted to healthcare is already in motion, but is imperiled by abdicrats. Absent government, Capitalism co-opts the necessities for humanity and commercializes partial solutions. Free markets are necessary, but alone are ineffective to addressing cultural pillars for how we educate, care, and conduct our increasingly connected and urbanized lives.

Half of Puerto Rico tonight is living in the dark. Volunteers from the Mennonite Disaster Service have been on the ground there since September. Helping people takes a vision that is connective, and it takes the risk of being present with and investing in others. It is possible to have wealth absent values, but that ultimately results in a zero sum game.

For good or bad, we are each other’s social assets and hope. The creativity that drives art and culture should be part of how we invest effort and assets. Acts of kindness to neighbors on a cold night, or telling a friend who is far away that you love them, may be our best investments.

Researchers warn that loneliness and social isolation is becoming a greater public health threat than the widely discussed problem of obesity. As more people live alone, and hew to an always on cloud of work and the meta-world of social media, more feel unwanted, what Mother Teresa termed “the most terrible poverty.” People who give a damn hold our world together. Finding and joining them may be the genius move of the next year.

When little is certain, much is possible

Whether you’ve had a great or trying year – I hope that the doors to change are open to you. And that your friends and colleagues are aligned around something you can share and advance in optimism together. The difference between heaven and hell is who you find yourself with. I hope you’re healthy, with good people, and are ready to gladly make your mark.

It’s a given that things will change. As managers, designers, and people who believe, making those be changes to be for the better is to us.

Happy New Year, and best wishes from Boston, Dave.

The future of digital experiences will be built by strategists who grasp the full array of emerging business, social, and technical models. Specialties in user experience, branding, application design, and data science are laying the foundation for richer user experiences and business models breakthrough products and revenue based marketing.

The future of digital experiences will be built by strategists who grasp the full array of emerging business, social, and technical models. Specialties in user experience, branding, application design, and data science are laying the foundation for richer user experiences and business models breakthrough products and revenue based marketing.

7 Responses to "Bitcoin Bros and Anxiety at the Top of the Business Cycle"

January 7, 2018

Thank you very much for this information friend, excellent article !!!

August 15, 2018

thank you for the information.

August 23, 2018

excellent article !!! thank you for the information.

August 27, 2018

excellent article !!!

March 7, 2019

I’m starting in this business.

September 2, 2020

Free sexy chat with hot local ladies only at hobbyhuren bergedorf

July 13, 2022

Wow, I love it! Thank you so much for sharing