Get rich quick? NFTs build a business on bragging rights for COVID-euphoric investors

At this time last year, the world was in the grip of a deadly pandemic. I’m surprised by how easy it is today to forget its dramatic impact. Countries accounting for half of world GDP were quarantined. In just one month, consumer spending in the U.S. dropped by one-half, and defaults and forbearances in the U.S. quadrupled. The San Antonio Express reported on a 10,000 person food line. The unemployment rate increased from 3.5 percent in February to over 19 percent in April.

But then, as work-at-home investors put their Covid-19 fears aside, they started a wave of recovery that led to a market euphoria—fed by ever more speculative and risky investments.

Welcome to the roaring and risky 20s

The resilience of the stock market has emboldened individual investors who now have a hunger for risky high-growth investments. From piling into Tesla, pouring into cryptos, and pulling one over on hedge funds in the Game Stop short squeeze, those on the ascending path of our K-shaped COVID recovery are up for risk.

There’s a feeling of invincibility among many individual investors and new exotic ways are emerging for them to speculate and find profit through increasingly uncertain assets. We’ve seen this in high-value purchases by collectors. For instance, last month The New York Times reported on StockX, a trading platform for sneakers, where a pair of Nike Dunks sold for $33,000.

Sneakers are just one collectibles market that’s hot right now. 2021 has also seen a boom in sports card trading. Want to know why someone would pay $5 million for a baseball card? Spoiler alert: It’s the belief that someone else will pay more. Combine sentiment, greed, and just a hint of scarcity, and those with gains from other speculative markets will climb aboard something new. That’s what NFTs are, a bubble fed by the proceeds of earlier speculations.

So what are NFTs, really?

If you own a car or home, there is a physical title filed away that says who owns it, and that record gets updated if it’s sold. It’s easy to image how blockchain, a secure public ledger, could keep track of who owns physical or digital goods.

That’s what NFTs do. They are blockchain ledgers that record the ownership of digital assets and enable buyers and sellers to exchange them directly. The abbreviation NFT stands for non-fungible token, suggesting that—, just as the deeds in the title office aren’t’ uniform and all of the same value—, that entries on this ledger are non-uniform too. Big money is being spent for these digital titles to some downright whacky assets. So, we’ll look at some notable sales and then get a handle on how this works or goes off the rails.

NFTs: Foolish fad or a new asset class to own digital culture?

Sports:

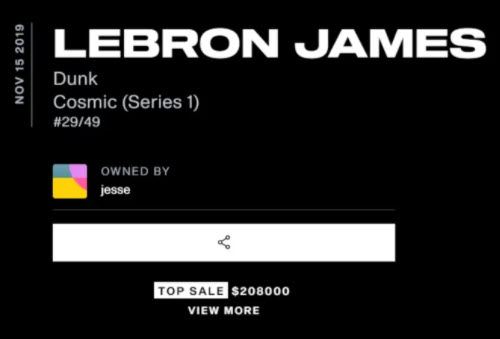

Non-fungible tokens or NFTs move investors from collecting physical items to tokens conferring ownership of digital assets. In these cases, the ownership documented is of a file, but not the intellectual property it contains. In February, a highlight clip known as a “moment” showing a LeBron James dunk sold for more than $200,000. Over at CNBC @TJHuddle reported this blockchain-based marketplace saw more than $150 million in sales from NFT highlight clips just during the final week of February.

From NBA Top Shot

Pop Culture:

Also in February, internet sensation Nyan Cat sold for about $590,000 on a two-week-old auction site called Foundation. It wasn’t the .gif file that was sold, which can be found everywhere online, but an entry of ownership on Ethereum blockchain, which established its scarcity. hat’s the rub: How scarce is NFT ownership of something that is free and already all over the internet?

Music:

This week the Wall Street Journal has covered NFTs daily. Yesterday’s piece on the music industry reported that “from June through Friday, some 29,800 NFTs involving musicians have generated $42.5 million in primary sales, with an average per-unit transaction value of $1,427.”

From Bloomberg TV

The same WSJ coverage featured Electronic music artist Justin Blau, who made a tokenized release of his three-year-old album “Ultraviolet”. The release grossed $11.6 million including a single purchase of an NFT, $3.6 million. In a frenzy where buyers race to be early in on trends, it’s awesome to be a seller.

Art:

Last week, news of an art auction that started at $100 and ultimately sold a digital file by an artist known as Beeples for $69.3 million stirred debate in both the art and investment worlds. Suddenly friends who are artists and musicians began mentioning to me that rights to their digital works were for sale in marketplaces using NFTs.

Crossroads artwork by the artist Beeple sold as an NFT for $6.5 million

If your art is somewhere near the intersection of social media and crypto-culture, and you have fans eager to affiliate themselves with your work, then NFTs may be a way to gain revenue and connect better with part of your audience.

As I’ve noted, selling into a frenzied market can be an amazing opportunity. But in such circumstances, caveat emptor counts extra for buyers.

Buyer beware: The Tinker Bell effect

Tinker Bell asserted that if you believe you can fly, you can. By extension, The Tinker Bell Effect suggests that a willing buyer’s enthusiasm is all it takes to substantiate a good’s value. As long as new, more generous buyers can be found – that river of belief can make anything a treasure.

This appetite for synthetic scarcity may be a vexation of late-stage capitalism. Once their essential needs are met, people may simply wish for things others cannot have, to show they’re special. Herbert Marcuse, the author of One Dimensional Man, held that advanced industrial society creates these false needs to tie people to production and consumption. Can there be a need more false than the desire to own a claim to an asset beyond one’s control?

NFTs build a business model on bragging rights

There’s a common phrase for earning an asset you can’t monetize, bragging rights. This phrase used to connote an activity driven by passion and for fun. NFTs have essentially build a business model around bragging rights. The more one pays for bragging, the greater their bragging will be.

Monetization must happen before commoditization

Typically, luxury brands take on investment (monetization) first; then over time, they drive growth by reducing exclusivity while lowering their margins to gain mass appeal. This is a recognized pattern in everything from North Face jackets to prestige brands in higher education.

NFTs take the reverse path, by taking something easily distributed, or already available freely and then selling what amounts to conferrable bragging rights. As they use elements reminiscent of other bubbles that have enriched investors (think collecting art meets Bitcoin), buyers may pile in for awhile. But after the speculative fervor subsides, those who don’t sell early may end up with ‘nothing burgers’.

Not everyone will agree with me on this right away, and that’s okay. Because I still have this rare and very special token for the copyright of a certain bridge in New York — just imagine the bragging rights. ;>

The future of digital experiences will be built by strategists who grasp the full array of emerging business, social, and technical models. Specialties in user experience, branding, application design, and data science are laying the foundation for richer user experiences and business models breakthrough products and revenue based marketing.

The future of digital experiences will be built by strategists who grasp the full array of emerging business, social, and technical models. Specialties in user experience, branding, application design, and data science are laying the foundation for richer user experiences and business models breakthrough products and revenue based marketing.

72 Responses to "Get rich quick? NFTs build a business on bragging rights for COVID-euphoric investors"

July 5, 2021

While it is true that investing during this time is risky but if you will be fortunate enough you might hit the jackpot.

November 22, 2021

There’s no telling how things will change in the future, might be a good buy with the right research.

December 17, 2021

Those with gains from other speculative markets will climb aboard something new.

– pittsburgh roofing company

December 21, 2021

I totally agree on this! I think we all should!

January 10, 2022

Thanks for the post.

January 10, 2022

Awesome article you shared here.

January 19, 2022

Interesting. Investing in a business is a risk whether there’s a pandemic or not. You just have to learn the fundamentals and how to handle complications. That’s what we do in Columbus all the time.

January 25, 2022

Wow! This is great post.

January 28, 2022

I think we’ll be hearing a lot more about NFT’s!

February 4, 2022

Clear explenation about NFT’s, thanks!

February 16, 2022

NFT companies has had rapid growth and success during the pandemic since a lot has been locked down on their houses or even offices.

https://www.us-mailing-change-of-address.com

February 17, 2022

Thanks for a great explanation of NFTs. I need to look at this closer, but I am interested.

February 20, 2022

[…] Last Spring, I staked-out some what I believed were the business weaknesses of NFTs used as tokens for collectibles. (see the post here) […]

February 23, 2022

There’s no denying that NFTs are starting to dominate worldwide.

the best Tampa SEO

March 28, 2022

Thanks for bringing up this topic about NFT I always heard about it and I’m really curious. https://favy.com/

March 29, 2022

Oh not shocking as I thought it would be. site

April 8, 2022

But after the speculative fervor subsides, those who don’t sell early may end up with ‘nothing burgers’.

April 15, 2022

Wow, I love it! Thank you so much for sharing

April 19, 2022

We are providing the best possible solution to the users. With our action-oriented approach, we help users with their Att.net email account login and settings. Therefore, if you have any questions regarding your account, please feel free to visit our website. Whether you have a problem with your email account or just need to log in, we can help.

April 19, 2022

Roadrunner email login

April 19, 2022

Bellsouth Email Login

May 2, 2022

Glad to check this awesome article here.

May 3, 2022

We enable users to access their Arlo camera setups without facing any issues successfully. So, if you are also looking for the Arlo log in, consider visiting our website because here, we help users install, log in, and troubleshoot their Arlo Camera setups. Thus, take a minute to visit our website to find out all the information about your Arlo Camera setup.

May 13, 2022

Great website content. Keep sharing the great work.

May 17, 2022

The resilience of the stock market has emboldened individual investors who now have a hunger for risky high-growth investments. See: https://stgeorge-atvrentals.com

May 17, 2022

Wow, I love it! Thank you so much for sharing

July 5, 2022

Such an informative site. Thanks for sharing this one.

July 17, 2022

Awesome post thank you for sharing check article here Securities Fraud News

July 22, 2022

Interesting post!

July 22, 2022

Glad to check this awesome article here.

July 26, 2022

This is great! Thanks for the share.

July 27, 2022

There are many different ways to create a PDF document. You can use a word processor like Microsoft Word, or you can use a dedicated PDF editor. In this blog post, we will discuss the benefits of using an online PDF editor. We will also compare the different online PDF editors that are available on the market.

August 8, 2022

Nice site. Keep up the great work No Fee Class Action

August 9, 2022

Your post is very good and very different. Your post will be very useful for me because I like these articles very much, I am thankful that I found this. for More Details Click Here:- Setup SBCGlobal Email on Outlook

August 22, 2022

It’s nice seeing this awesome info here.

August 22, 2022

Thank you for sharing this informative article.

August 24, 2022

This would be a great investment. Thank you for sharing.

Local junk car removal

September 5, 2022

There are various ways that a LinkedIn Advertisement Agency can help your business make and impact the web. In any case, we can make strong regions for a mission that will appear at your essential vested party and make leads. What’s more, we can deal with your focal objective so it is reasonable and produces results. Finally, we can outfit you with allure and class on the most talented technique to best utilize Linkedin to help your business. Reach us today to get more to know how we can help you!

September 5, 2022

There are various ways that a LinkedIn Advertisement Agency can help your business make and impact the web. In any case, we can make strong regions for a mission that will appear at your essential vested party and make leads. What’s more, we can deal with your focal objective so it is reasonable and produces results. Finally, we can outfit you with allure and class on the most talented technique to best utilize Linkedin to help your business. Reach us today to get more to know how we can help you! LinkedIn Advertisement FL

September 7, 2022

Looking to make some simple changes to your PDFs but don’t want to spend any money? Look no further! Edit pdf Free is here to help. We offer a range of tools that allow you to edit your PDFs without having to spend a penny. Whether you need to add text, change the formatting, or just make a few quick edits, we can help. Plus, our tools are easy to use and completely free!

September 9, 2022

Appreciation for sharing such a cerebrum blowing information.. It truly obliging to me.. I for the most part search to take a gander at the quality substance finally I found this in you post. keep it up!

http://fernandoxint875.wpsuo.com/the-most-influential-people-in-the-facebook-advertising-agency-tampa-industry

September 16, 2022

Thanks for sharing this great content here.

September 16, 2022

Awesome post!

September 22, 2022

Looking for a powerful pdf editor that doesn’t require a steep learning curve? Look no further than A1office Pdf Editor! This software is easy to use and can help you accomplish a variety of tasks, such as adding text, inserting images, and creating PDFs. With A1office Pdf Editor, you can make your documents look professional and polished in no time!

September 28, 2022

Instant money also can lose instantly.

Anne | drywall professional

September 30, 2022

Reussite Technology is one of the Best Web Development Company in Delhi NCR. We deliver the best web development services to our clients. Connect with us today.

October 1, 2022

Glad to visit this amazing blog. Gonna share it with my friends.

October 7, 2022

It’s nice seeing this informative content.

November 28, 2022

Is it difficult for you to share your PDF file or document with your friends? It will not because I’m going to tell you about very amazing A1Office PDF editor that will help you to share your PDF file or document very easily to your friends or wherever you want to share for free .

January 2, 2023

Many will love this article. Thanks for sharing!

February 1, 2023

Thanks for sharing these great tips regarding blog commenting rental properties

February 8, 2023

This is nice article you shared great information i have read it thanks for giving such a wonderful Blog for reader. General Contractor in Fort Worth

February 8, 2023

This is pretty great post. I´ve been thinking of starting a blog on this subject myself. Bathroom remodeler

February 8, 2023

Thank you for this wonderful article. Schedule Free Estimate

February 8, 2023

Nobody really tells you how commenting should be done properly and that is why people think leaving a simple ‘great post’ comment will get them backlinks.

Kitchen remodeler

March 24, 2023

Thank you for sharing this great post. Small Multifamily Properties

April 3, 2023

Wow, I love it! Thank you so much for sharing

April 10, 2023

Your Blog is very nice.

Wish to see much more like this. Thanks for sharing your information Property Management

May 1, 2023

Thank you sharing for this great post.

Tampa Property Management

May 10, 2023

You have a great information! Thanks for sharing

May 25, 2023

I found this blog post to be incredibly helpful and informative. Understanding the terms and conditions of a lease is crucial before signing any rental agreement, and this article covers all the essential aspects one should know. Book a Vacation

June 2, 2023

Quality Content! really not surprised! Alturas Florida Property Management

June 14, 2023

We offer assistance for setting up Linksys WiFi extenders. Our team can guide you through the process of configuring and installing your Linksys WiFi extender to ensure optimal range and coverage for your wireless network. With our expert guidance and step-by-step instructions, you’ll be able to extend the reach of your WiFi signal and enjoy a reliable and seamless connection throughout your home or office. Let us help you enhance your WiFi experience with a Linksys extender setup.

June 16, 2023

I’ve read many articles about blogging, but never one about how to make effective and valuable comments.Clearwater Property Management

June 17, 2023

Best Barcode Billing Software in Mumbai. suits all kinds of businesses and all requirements. It is easy to learn, implement, and use without having to call for specialists in Mumbai ,India.

June 19, 2023

I totally agree with this blog. Very interesting. http://www.google.com/maps?cid=16995811405655708456

June 28, 2023

Thanks! The mental image of you writing down notes while reading makes me smile. St Petersburg Property Management

July 3, 2023

Good luck then! Pasadena Drywall Contractors looking forward to witnessing your success. 🙂

July 28, 2023

HERE MILLONAIRE SECRTS BOOK LINK

Your blog post was a valuable source of information. I appreciated the way you presented the content and the key takeaways you highlighted. To learn more, click here.

August 9, 2023

Well-written and informative article. If you’re interested in learning more, I suggest click here for supplementary resources.

September 18, 2023

Your post is well-structured and organized, making it easy to navigate and find the information I need. For more details, click here.

October 31, 2023

The price of an Anti-Müllerian Hormone (AMH) test in Delhi can vary depending on the healthcare provider and location. On average, the cost of an AMH Test Price in Delhi typically ranges from INR 800 to INR 2000. However, the specific price may differ based on the laboratory, diagnostic center, or clinic you choose.

It’s advisable to contact different healthcare facilities in Delhi to inquire about their current pricing for the AMH test, as rates may change over time. Additionally, insurance coverage or discounts may affect the final cost, so it’s important to consider those factors as well.