As world banks cut rates to zero – investors face a harsh set of opportunities

Last night the Federal Reserve made its second emergency rate cut in a week, dropping its short-term benchmark rate by a full percentage point. Here’s what you should keep in mind: the Fed’s Open Market Committee has its quarterly rate-setting meeting scheduled for Tuesday. It couldn’t wait a day to pump liquidity into the markets.

This is a significant risk signal, both because of the need for abrupt action, and because the moves of the last week effectively exhaust the policy tool kit of the world’s central banks.

I try to acknowledge uncertainty where it exists. And there is, of course, no shortage of that in today’s market. However, these moves appear to leave the world financial system defenseless not only to future onslaughts of selling, but a mix of illiquidity, global recession, and price distortions.

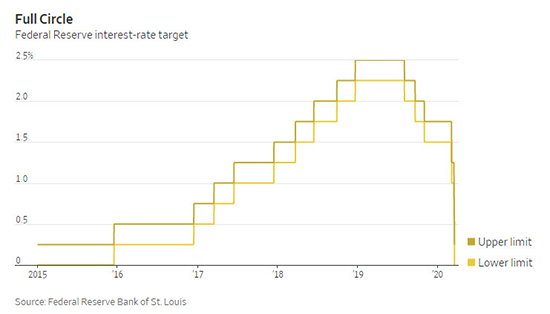

The abruptness of the last week’s interest shift is illustrated in this WSJ graphic showing years of measured quantitative tightening as interest rates moved toward normal levels after the financial crisis of 2008.

While the US is an important player, the story of the Coronavirus and its economic impact is clearest from China’s perspective. This is both because we can watch and learn from the impact of this pandemic from where it started, and because its economy its self is at risk of economic and social disruption. When China gets sick, American markets catch the chills.

As the US Fed lowered weekend interest rates, The People’s Bank of China pumped 100 billion yuan ($14.3 billion) into the financial system. It also announced it would cut the amount of cash banks need to hold as reserves by 50 basis points, injecting around 550 billion yuan ($78.6 billion) into the economy. These moves seem focused on responding to a profound economic shut-down.

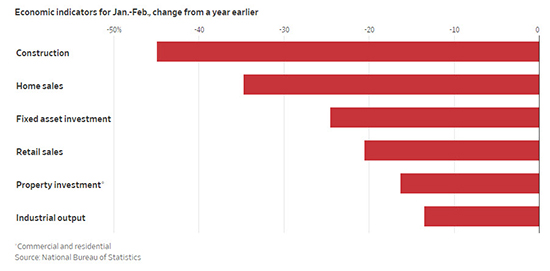

Fresh data from China shows the economy has been hit harder than expected by the coronavirus outbreak. Analysts at Reuters had forecast a meager 0.8% rate of retail sales growth in the January to February period. Instead, they plunged over 20%. Industrial output also fell 13.5% during the same period, while fixed-asset investment plunged 24.5%, also widely missing estimates.

A harsher economic terrain for investors

This market change is from a non-market force. It is a meteor hit that disrupts markets functioning as usual. When the housing crisis began, a colleague at Thomson Reuters advised it would probably take five years for the economy to regain its footing. Big drops often come with long recoveries.

Though it is generating waves of volatility, especially as banks of pumped liquidity into markets, its effect is unidirectional. Yes, this is a historic event that will pass. Optimists have a hard time enduring real downturns.

It is likely impossible to geographically diversify around a pandemic. The safe havens of oil and more broadly energy are disrupted the lower consumption accompanying economic shut-down, and producer price war. Likewise, precious metals such have fallen with markets, as have bitcoins and bond yields. Will precious metals kick in later as a flight to safety?

One way to hedge against future declines is through RYURX the Rydex Inverse S&P 500® Strategy Fund. I consider this to be an efficient way to invest in contracts that increase in value as markets broadly drop. If you are someone hanging on to equities knowing they will gain value again in time, have some investment in this can offset what may be material short term losses among stocks.

Here are some thoughts on who looses and wins. Banks tend to profit less during periods of low-interest rates. Employment disruption will likely drive increased consumer debt in the short term. We already see record consumer debt, so this will help the major credit cards as long as default rates are low.

Beyond this, you may look for safety plays or bargains, or in time to diversify away from currencies being devalued to stimulate economic growth. Kimberly Clark is my favorite example of a safety play, as there near structural demand toilet paper and hand towels.

Conversely, A PK colleague of mine is buying up beleaguered airline stocks. He imagines this is as bad as it can for airlines, literally because governments are likely to protect airlines from insolvency. While governments do seem prone to prop up prices and industries. I’m skeptical of investing in the moral hazard now surrounding my colleague’s airline stocks.

My advice to him was to enjoy last week’s fantastic discounts on airline tickets. But as borders close and travel is banned, we’re reminded that the reality of this economic markets are lived daily. Being unable to send children to school, buy or sell goods, or feel confident in the availability of medical care – are forces for change themselves.

Change and uncertainty are why we have equities markets. The question for investors today is how much appetite do we have for risk, and how long will that last? Markets will eventually regress to their means. Today, we need to figure out how to be happy and thrive during difficult times.

Disclaimer: I may hold or trade securities mentioned here. I receive no consideration from any entity for what I say here or elsewhere in social media.

The future of digital experiences will be built by strategists who grasp the full array of emerging business, social, and technical models. Specialties in user experience, branding, application design, and data science are laying the foundation for richer user experiences and business models breakthrough products and revenue based marketing.

The future of digital experiences will be built by strategists who grasp the full array of emerging business, social, and technical models. Specialties in user experience, branding, application design, and data science are laying the foundation for richer user experiences and business models breakthrough products and revenue based marketing.

2 Responses to "As world banks cut rates to zero – investors face a harsh set of opportunities"

March 19, 2020

[…] what is an investor to do? Yesterday, I noted that the Rydex Inverse S&P 500 fund could be a good way to bet on mayhem. But, for those with […]

April 17, 2020

Please keep on posting and sharing great ideas. I enjoy reading the all your articles.

https://stalbertdentists.ca