The week when Google entering healthcare scared people while I was in London

Hi, this is written from the road and is published with illustrations and some copy editing still to happen.

The view from the road:

After a month or two of business travel taking me to Dallas, Grand Rapids, Seattle, Orlando and Nashville I took a week off to relax, in London.

I’m back with business and advertising insights which already are showing up on my general interest Twitter account @Usefularts, and my health tech account @ChiefHealthTech. I’m already seeing Boston with a new perspective. ;>

This week’s fixations:

1. Google’s entry to healthcare inspires widespread scrutiny

Whistle Blowing is part of the contemporary lexicon. Here’s an explanation in London’s Guardian by the self-described Whistleblower who broke Google’s Project Nightengale – a health data partnership they made with Ascension Health that could give them access to data mine fifty million patient health records. A headline in The Atlantic in America described this as “creepy health data harvesting“. Also, Friday, WSJ did a deep dive on the ways Google engineers is search experience to maximize revenue and stack results to the favor of its advertisers and products. The combination of Project Nightengale and Google’s purchase of Fitbit has raised the profile of its ambitions in healthcare and triggered new levels of public scrutiny.

2. Health Research from OHSU confirms patients ignore semi-useless healthcare portals

Having spend months working in Portland, Oregon and you may know I idealize the city as America’s Eden. The state’s only academic medical center, OHSU has a local brand equity on part with Nike, and like that local brand hero, OHSU actively researches how to make great digital patient experiences.

New research by OHSU shows that only about 10% of patients with access to electronic medical records have actually accessed their care data. “This suggests that there is significant room for improvement in engaging patients with their information electronically,” the study team, led by Sunny Lin of Oregon Health and Science University-Portland State University School of Public Health, wrote in Health Affairs.

Of course the less positive side of this coin is that according to Kaiser Health News, the US Government has invested $36 billion into getting over 90% of patient treatment in Electronic Medical Records — with little to show for its investment.

3. Healthcare data leaks cost the system $4 billion annually

One of the discussions my team was part of recently focused on the benefits of health systems buying insurance against data leaks and ransom demands to regain data. You may know that hospitals are the most targeted victims of ransom wear attacks. ClearData Founder and Chief Security Officer, Chris Bowen, has a smart post of the significant costs of data insecurity to the care system, and suggests it is past time to fix this.

4. The Trump administration announced steps to force price transparency on the negotiated rates between payers and health systems. There’s some early speculation that this requirement may be toothless as the fine for noncompliance seems incidental.

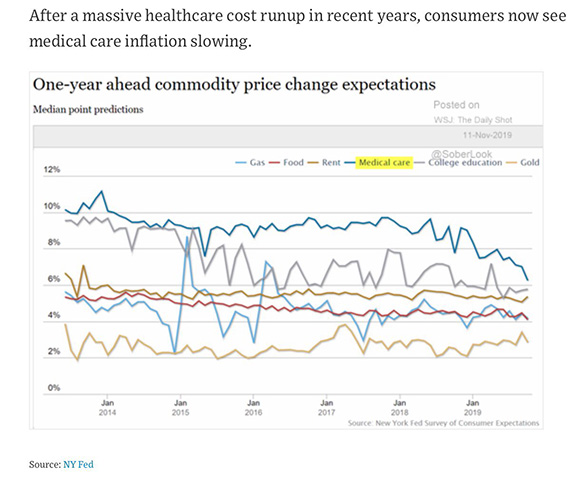

5. And good news, the New York Federal Reserve projects that healthcare inflation will decrease over the next year. The combination of consumerism, high deductible plans, and regulation seems to be slowing healthcare spending’s growth.

Technology of the week: my Google Pixel Phone

I’ve worked from London twice, so I know the drill for swapping SIM cards, upgrading plans, and the extra fees that can show up anyway. So, this week’s killer tech was my Google Pixel Phone. Google aggregates worldwide coverage from various providers which they manage as Fi Network. So, wherever I go, the Fi Network keeps me connected with no extra data charges or fees. That’s so much better than, well, having to do anything extra. Instead, I just walked off the plane, asked my Pixel for directions to my hotel by voice – and followed the heads-up Augmented Reality map that guided me to the Tube where the subway whisked me to the cheap but comfy hotel. This is my second year on the Pixel phone; its been a good ride.

A word on investing in treacherous markets

I’m overdue to write a post on the madness of “Perma Bears” — the chattering analysts perpetually on edge that risk markets are overpriced and about to correct. Yes, markets to do correct, and every few years these predictions come true. But over time growth exceeds risk. Part of my work advising organizations on navigating digital transformation is helping them to spot and focus on making winning moves. Doing this with personal investments is one way I stay engaged with (literally invested in) the trends fueling progress in our lives.

Last December (11 months ago) I identified LAM Research Corp. (LRCX) as a beaten-down leader with a still dominant share of its competitive space. LAM brings hardware, software, process, and process-control materials together, with an expertise in the highly specific etch, deposition, and clean processing of the manufacturing of semiconductors, mostly for high performance memory – a mainstay for both Artificial Intelligence and the Internet of Things. You may remember last year that semiconductor stocks got destroyed between Thanksgiving and Christmas last year, which is the right time to buy equities — when fear blinds buyers to opportunity and the market’s ‘animal spirit’ is gone.

LAM was a beaten down gem. Besides a 90% market share, they had $3 billion in cash from operations on their books. The $160/share entry price from last December crossed $283 this week — which is just an awesome climb in under a year. Do you remember hearing speculation that “markets correct in September“, then the same prediction for October? Its November, and the markets are setting records, in a record setting year.

The two greatest investment and strategy risks are not participating in change, or not picking winners by betting every square on the table. What often passes as investing is just picking a pack to follow. Its easier for some people to imagine being wrong in a group than going against the grain and buying hated or unproven new companies ignored by others. This dynamic puts people on the wrong side of trades, leading them to sell at the bottom of a descents, and jump in during the late days of irrational exuberance.

As a business strategist, I help leaders assess risks and opportunities around digital change. Everyone who manages a budget is making a risk to reward calculation not unlike my choice to heavy in on Lam. But like pack investors, there’s a tendency to take last year’s budget, just slightly increase it, and to not engage with uncertainty and the opportunities it brings.

As you think about next years plans — this season of light and reflection is a perfect time to look for strategic clarity. Making next year disproportionately rewarding starts with finding opportunities the rest of the world is missing today, and quietly building a path to be part of that new growth. Its time to decorate for holidays, and lay plans to celebrate in the new year.

Have a great weekend. D.

The future of digital experiences will be built by strategists who grasp the full array of emerging business, social, and technical models. Specialties in user experience, branding, application design, and data science are laying the foundation for richer user experiences and business models breakthrough products and revenue based marketing.

The future of digital experiences will be built by strategists who grasp the full array of emerging business, social, and technical models. Specialties in user experience, branding, application design, and data science are laying the foundation for richer user experiences and business models breakthrough products and revenue based marketing.

8 Responses to "The week when Google entering healthcare scared people while I was in London"

December 6, 2019

Pretty cool post. Lots of good information.

Windsor On

September 13, 2020

If you want to enjoy sexy chat with hot local ladies visit oma sex!

November 26, 2021

hausfrauensex is the most popular web platform for casual contacts with fine girls in EU

January 22, 2022

Transexuelle Lille is great web portal for you if you are alone in France

April 28, 2022

Wow, I love it! Thank you so much for sharing

August 10, 2022

Wow, I love it! Thank you so much for sharing

April 25, 2025

Lust auf eine Hausfrau? Fühlen Sie sich zu sexy, reifen Frauen hingezogen? Diese findest Du auf der Webseite: https://beste-hausfrauen-sex.de/ Starte mit einem heißen Sexchat und dann vielleicht unverbindlichen Sex in Deiner Nähe?

August 26, 2025

Interesting take! Spotting winning moves is key, and the “Perma Bear” mentality can paralyze. It’s like playing Drift Boss and only braking – you’ll never reach the next level. Focusing solely on risk ignores the potential for growth. We need to balance caution with the willingness to strategically invest in the future. Thanks for the insightful perspective!